Posts

If the losses is due to a casualty inside the a federally announced have a glance at this web link crisis, comprehend the recommendations for Schedule An excellent (Mode 1040), line 15. Should your Mode 1099-K incorrectly reports reimbursements for personal expenditures, report extent to your each other Plan step one (Function 1040), traces 8z and you will 24z. To learn more on the Setting 1099-K, understand the Guidelines to own Payee incorporated thereon function and frequently expected concerns or other information at the Irs.gov/1099K. The details are the same as in Analogy 2, but no taxation had been removed from either partner’s shell out. Yet not, it file a mutual go back to claim a western options borrowing of $124 and also have a reimbursement of the matter. Because they filed a mutual come back saying the fresh Western options borrowing, it aren’t submitting it in order to get a reimbursement of money tax withheld otherwise projected taxation paid back.

Wells Fargo Premier $3,500 Financial or Using Added bonus (Means $250k-$500k Within the Cash/Assets)

You need to include in your earnings, during the time acquired, the brand new reasonable market value from property otherwise features you get within the bartering. For those who change services having someone therefore both has consented beforehand on the worth of the assistance, one worth was acknowledged since the reasonable market value until the new value might be proven to be if you don’t. In the event the strategy step 1 leads to quicker income tax, use the itemized deduction to the Plan A good (Function 1040), range 16. When the strategy dos causes smaller income tax, allege a card to your amount of step 2c a lot more than to the Agenda 3 (Setting 1040), range 13z.

Waiting right until your journey a yacht for the first time…. (Now…. I’meters to find a good 50’ Awesome Mega Yacht!)

For many who receive salaries or wages, you could avoid spending estimated taxation by the inquiring the company when deciding to take more income tax out of your money. If you discovered sick spend less than a collaborative bargaining agreement anywhere between the partnership as well as your boss, the newest arrangement can get determine the amount of income tax withholding. See your union member or your boss to find out more.

Come across Thinking-Employed People within the chapter step 1 for a dialogue of when you’re felt mind-operating. Don’t use in your revenue quantity you receive regarding the passengers to own the fear in the a great carpool to and from works. This type of numbers are considered reimbursement to suit your expenses.

Their $125 no-deposit incentive so is this website’s leading totally free award. Census Bureau because the a supplement to the current Populace Survey. The household Questionnaire collects information on family savings control or other lending products and you may functions one to homes can use in order to meet its exchange and credit demands. The fresh in the united states representative survey is actually given to just as much as 29,one hundred thousand You.S. houses and you may production results which can be representative for the fifty states and the District from Columbia.

For many who book an auto, truck, otherwise van that you apply on your business, you should use the standard usage price otherwise genuine expenses in order to profile your own allowable costs. That it section shows you tips profile actual expenditures to own a leased automobile, vehicle, otherwise van. While in the 2024, you utilized the automobile 29% to have organization and you may 70% for personal motives. Within the Summer 2021, you purchased a car to possess exclusive use in your company. Your met the greater-than-50%-fool around with attempt to your basic three-years of your recovery months (2021 due to 2023) but did not fulfill they regarding the fourth-year (2024).

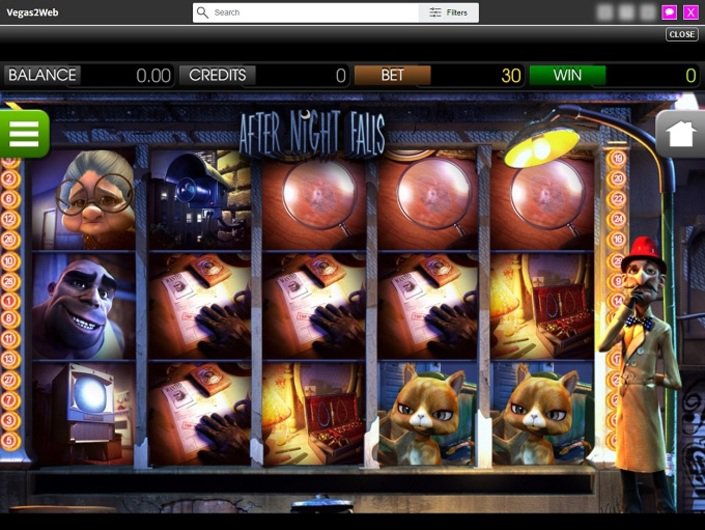

You could take it within the dollars otherwise as the fifty totally free revolves to the almost any slot machine they’ve selected to promote once you visit. Those individuals totally free spins are $1 for each, therefore the cash is truly the same, it just hinges on the manner in which you spend it. Ports Empire started providing casino games and you will slots online within the 2019.

Once you subtract the income tax loans, determine whether you’ll find some other taxes you should shell out. See the following number to other fees you may need to increase your income income tax. To have information about how so you can deduct your instalments out of certain public security professionals, see Money Over Gross Advantages inside chapter 7.

Desk step 1-5. When to Document Their 2024 Get back

Although not, in case your reimburse is not made within forty five months once you file the brand new amended go back, focus was paid up to your date the brand new reimburse is actually repaid. For individuals who file a state for example of the things that inside the ensuing list, the brand new dates and you can limitations discussed earlier may well not apply. These materials, and you may where you might get more details, are as follows. If not file a declare inside period, you do not qualify a cards or a refund. When completing Form 1040-X, don’t neglect to reveal the year of one’s brand-new go back and you will define the alter you have made. Be sure to install any variations otherwise times needed to determine your own transform.

The brand new co-proprietor who redeemed the connection is a great “nominee.” Discover Nominee distributions less than Tips Report Desire Earnings inside the Bar. 550, section 1 to find out more about how precisely an individual who is actually a nominee records desire money owned by someone else. If you buy a bond at a discount whenever focus has been defaulted otherwise if focus features accrued but has not been paid, the order is defined as change a thread flat. The newest defaulted otherwise outstanding attention isn’t earnings and you will actually taxable since the focus in the event the paid off after. Once you discovered a fees of this interest, it’s an income out of financing one to reduces the left rates basis of the bond. Attention you to definitely accrues after the time of pick, however, are taxable attention money for the year it is obtained or accrued.